BP has completed the acquisition of Lightsource

Our top story this month is BP has completed the acquisition of Lightsource, BP were already part owners of the business but have finalized the acquisition of the remaining 50.3% of the shares. In November 2023 BP announced an agreement had been reached to acquire the additional shares with the deal being finalized last month.

Joaquin Oliveira, Lightsource bp’s group chief executive, added: “I’m excited to begin the next chapter, taking Lightsource bp to a new level of profitability, growth and performance. We will continue to scale this successful business, and also apply its capabilities to support bp’s low carbon energy business.”

Avangrid secured two lease areas in the auction of sites for offshore wind development in the Gulf of Maine

Our second story is Avangrid announced it has secured two lease areas in the auction of sites for offshore wind development in the Gulf of Maine held by the federal Bureau of Ocean Energy Management. Avangrid was named provisional winner of lease areas OCS-A 0564, 98,565 acres, for $4.9 million and OCS-A 0568, 124,897 acres, for $6.2 million. Avangrid will work to develop the lease areas, with the potential to deliver 3 GWs of clean power, to help meet the energy needs of the New England region and advance the United States 30 GW offshore wind target. The lease areas also enable Avangrid to help progress floating wind technology, as the next generation of offshore wind development is increasingly sited in deeper waters.

Birch Creek has closed on a $150 million credit facility

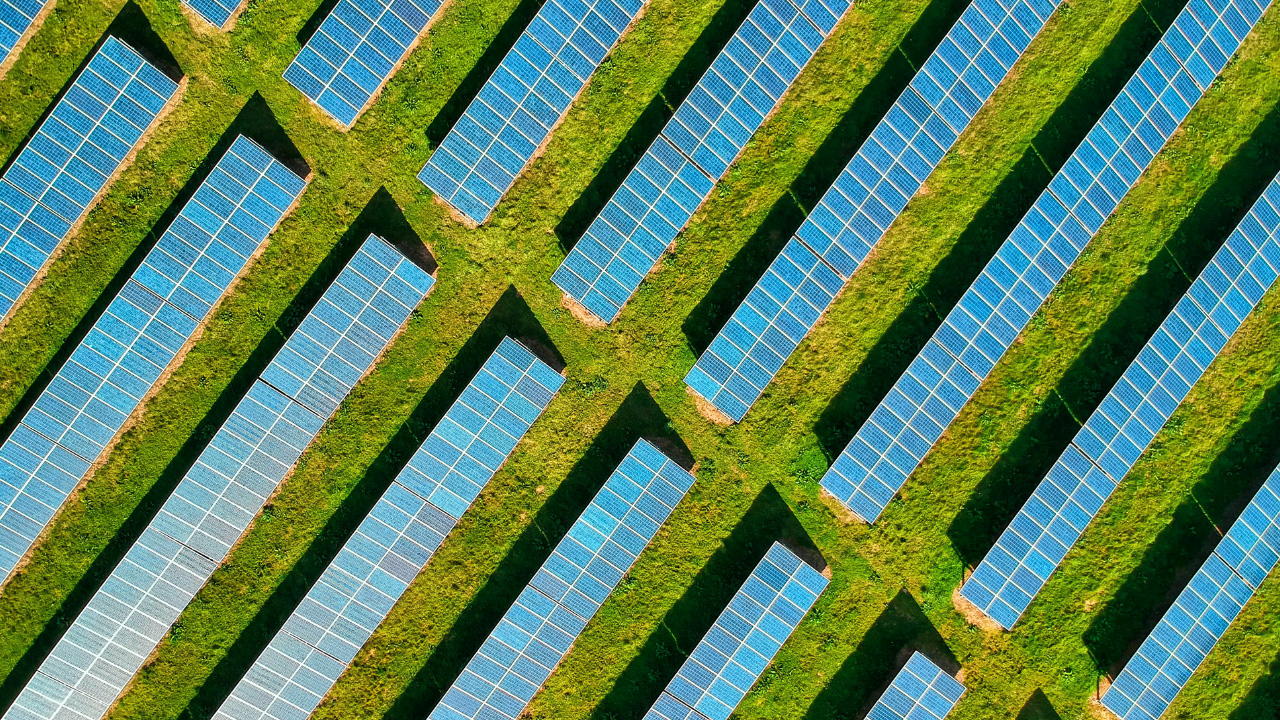

Our next story is Birch Creek Energy a utility scale solar and storage developer and independent power producer, and KKR, a leading global investment firm, announced that Birch Creek has closed on a $150 million credit facility within KKR's High-Grade Asset-Based Finance (ABF) strategy via insurance accounts managed by KKR. The financing extends and upsizes Birch Creek's previous $100 million facility, and it will be used to finance development expenses and equipment for solar farms in the company's development portfolio.

TerraForm Power named Mark Noyes as Chief Executive Officer

Our final story is TerraForm Power have announced that it has named Mark Noyes as Chief Executive Officer and President to further the company's strategy across existing and new opportunities for growth. Mark has over years of experience in the energy sector, previously he led RWE Clean Energy, where he oversaw significant growth in its portfolio of operational assets, reaching 10,000 megawatts, while building a project pipeline of 30,000 megawatts. Before that, he contributed to the significant expansion of another sector company, which grew its portfolio to 4,000 megawatts of operational assets before being sold.

They were the top stories from the US renewables market in November, if you enjoyed the video please give it a like, comment, share or even better all 3! If you have a renewable energy project coming up, CMC provide engineering, construction and project management services to help you deliver your project ahead of schedule and under budget, for more information visit www.expertisedelviered.com or reach out to myself directly on LinkedIn.