Do you remember when all your data was stored on just one computer? That’s definitely in the past with the exponential growth of data centres all around Europe. In 2024, the European data centre market revenue is expecting to generate a revenue of 77.9 billion dollars!

Large data centres operated by hyperscale providers reached 992 at the end of 2023 and surpassed 1000 in early 2024. This trend continues in 2024 and beyond, leading to promising projects and career paths. The profitable and pioneering market of data centres is evolving rapidly, which is why companies need to stay ahead of the curve by navigating future challenges.

Whether you are a data specialist looking for your next career opportunity, an ambitious employer, or just an interested reader, this article will give you all the new insights you need to know about the future of data centres in Europe.

Data Centre Leaders

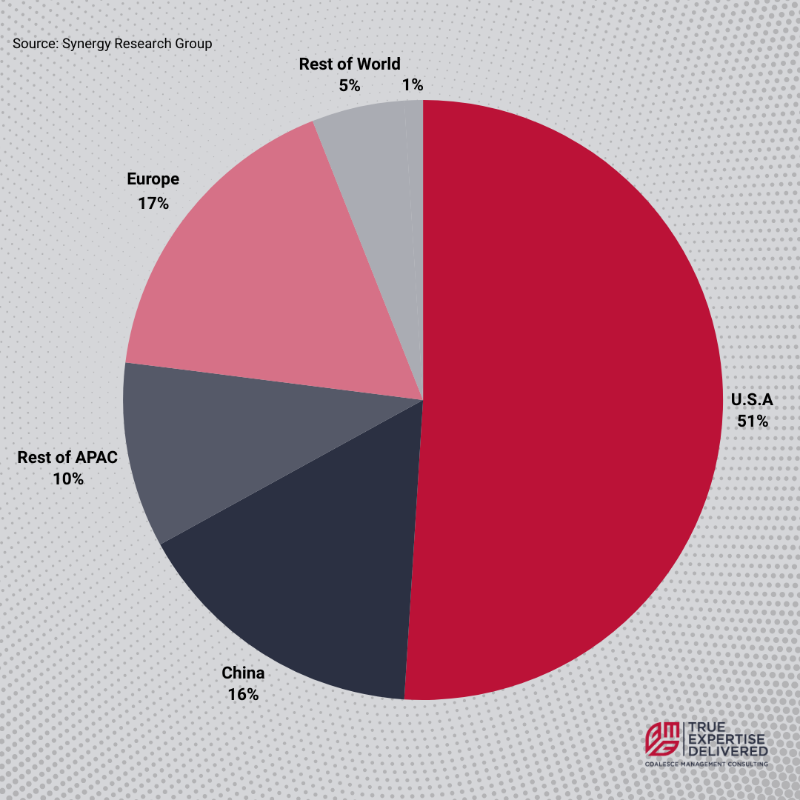

Figure 1: Data centres per region

The total capacity of data centres has doubled in four years, with the United States accounting for 51% of global capacity. Europe however holds second place with 17% of all data centres, which makes them a very promising market, especially since U.S is facing some difficult availability problems. China holds third place, accounting for 16% of data centre capacity.

The biggest data centre hubs are centred around Western Europe: Frankfurt, London, Amsterdam, Paris and Dublin or better known as the FLAPD markets. London and Frankfurt lead the European market with total estimated inventory respectively 1000 MW and 700 MW, while Dublin has the most capacity under construction. Despite England being historically the most active and biggest market, Germany is the leading country by number of data centres.

Particularly France and the Netherlands show growth in 2023, but the overall activity growth in Europe was remarkable with 29.7%. Besides the Netherlands and France, the FLAP-D markets are promising for investors, accounting for 80% of total MW demand in Europe. Moreover, the supply of these markets grew 17% CAGR while utilisation increased to 88%, while the secondary market grew 23% CAGR with utilisation increased to 82%. As a result of these numbers, the European data centre market shows expansion opportunities and increased popularity for organisations who are looking for alternatives for the space constrained American data centre hubs, such as North Virginia.

2024 will again be a growth year for every European data centre hub with an expected increase of 16% in data centre supply with 467 MW added to the FLAPD markets. Secondary markets in Madrid, Berlin and Warsaw will see an average 49% increase to their market size. To thrive in the European data centre markets, there are some challenges to overcome by companies.

Challenges in the Data Centre Market

Space and power Shortage

Building new data centres drives growth and innovation, but regions worldwide are facing space and power shortages due to the high demand. CBRE predicts the vacancy rate of the FLAPD markets to drop to 8.2% in 2024, which is 2.4% lower than in 2023. As a result, second-tier markets, such as Berlin, Milan, Zurich and Warsaw are very popular for companies who seek expansion and has an expected growth of 10% in 2024. However, even in second-tier markets there is a decline in vacancy rates.

Similar challenges are faced globally, as data centre demand continues to grow. The world’s largest data centre hub, North Virginia, only had 1.8% vacancy in Q1 of 2023, which caused construction delays. The lack of availability has also led users to secondary markets, which now make up almost 20 percent of capacity under construction, JLL said.

Singapore, the world's most power-constrained data centre market, experiences less than 4 MW of available capacity and a record-low vacancy rate of less than 2%. In South-America, Querétaro, has only 1.2 MW available for lease.

Higher prices and Efficiency

Due to the decreasing availability in Europe and the increasing popularity, construction costs increased between 2022-2023 with 6.5% to 9.1 million dollars per MW, with Zurich being the most expensive market in Europe and second most expensive market in the world. The second most expensive data centre hub is London, followed by Frankfurt. The collocation rent also increased accordingly with 9%-13%

In Singapore, rental rates are the highest, ranging from $300 to $450 per month for a 250- to 500-kilowatt (kW) requirement. In contrast, Chicago is the cheapest location for companies to build their data centres, with rental rates ranging from $115 to $125 per month.

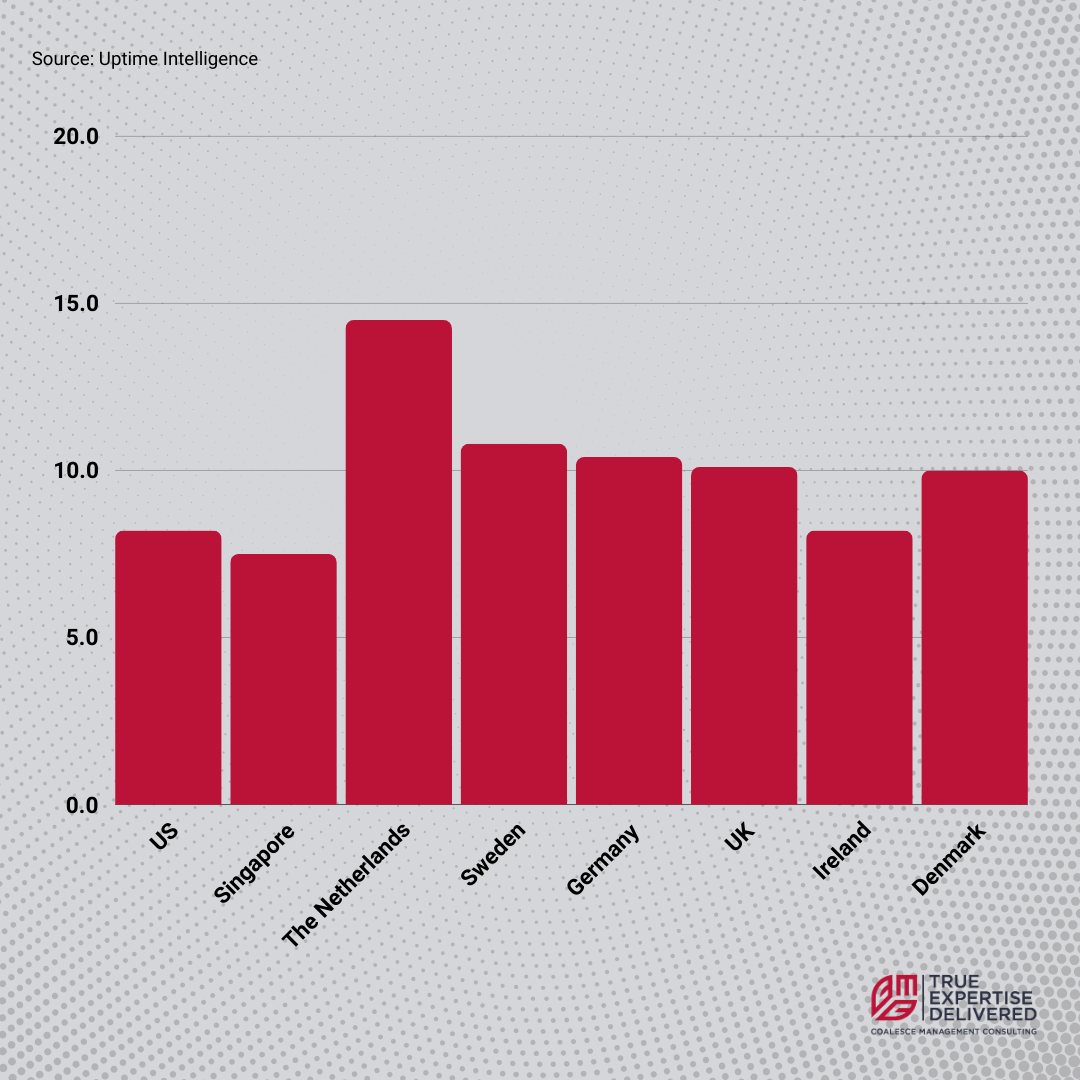

Figure 2: Inflation Rate September 2022

Overall, inflation is a challenge that every region in the world is facing. In 2022, the Netherlands experienced the highest inflation at 14.5%, whereas Singapore had an inflation rate of 7.5%.

According to the Uptime Institute’s Data Center and IT Spending Survey 2022, over two-thirds of enterprise and colocation operators anticipate higher data centre expenditures in 2023. Additionally, 90% of enterprise data centres plan to expand their IT or data centre capacity within the next two to three years. Half of these enterprises expect to construct new facilities, although they may also close down some existing ones. The main factors for higher costs are product shortages (such as raw materials for li-on batteries), higher labour costs, power, and semiconductors.

EU Regulation

The European Union is aware of the power and availability shortage and that’s why the Commission has adopted a new regulation and Energy Efficiency Directive for establishing an EU-wide scheme to rate the sustainability of EU data centres. The new directive obligates data centre operators to report the key performance indicators to the European database by 15 September 2024 and then by 15 May in 2025 and subsequent years.

The goal of these new legislation is to increase transparency and promote efficient designs and sustainability, such as renewable energy, since data centres account for 3% of EU electricity demand. With these reports and other legislation, the EU targets to reduce its energy consumption by 2030 with 11.7%.

Future Solutions of Data Centres

AI

AI, including ChatGPT and LLMs, is both the cause and solution of data centre shortages. In November 2023, ChatGPT had 100 million active weekly users and consumed as much power daily as 33,000 households. The higher prices and shortage of power and land has pushed organisations towards innovative solutions to optimise data storage and reduce the overall data footprint.

Investing in AI proves beneficial for companies aiming to reduce their data footprint. AI technologies streamline and enhance organisational activities, leading to decreased space requirements. Generative AI, a design tool, plays a pivotal role in this process by creating efficient layouts and solutions. Traditional design methods often lead to inefficient layouts with poor airflow, resulting in overheating and wasted energy.

According to Forbes Generative AI is revolutionising data centre management through several key advancements:

1. Energy-efficient layouts: The energy crisis has led to AI-driven design tools to optimise airflow, minimise hot spots, and reduce cooling needs, which leads to significant energy cost savings. Companies like Meta, Google and Amazon are already using this technology to reduce energy costs.

2. Predictive thermal management: To prevent overheating and ensure optimal server performance, AI analyses sensor data to predict temperature changes. If the system is overheating, the system will proactively adjust the temperature. Some companies have also changed their cooling system to high-density air-cooled systems or direct-to-chip (D2C) liquid cooling systems to compensate for the massive heat generation of the new, more powerful equipment.

3. Data-driven space utilisation: Companies need to rethink their lay-out by optimising their space, preventing high rental costs and construction delays. AI optimises the placement of servers and racks to maximise space and cooling efficiency, allowing for increased server capacity without additional physical space.

These innovations are estimated to reduce energy consumption by 20% or more, improve server uptime due to better cooling, and increase data centre capacity. Enhanced efficiency also makes on-site renewable energy more viable. However, these are industry estimates and may vary.

Cloud Computing

Cloud computing delivers services via the Internet, including data storage, servers, databases, networking, and software. With the rise of cloud computing, third-party companies manage and maintain data centres, providing infrastructure for other organisations. Cloud computing have the following benefits for companies who struggle to optimise their data centres:

Lower Costs: On-premises data centres are riskier due to unforeseen costs, such as construction delays, high rental prices and strict environmental laws. Cloud computing, however, allows utilities to access resources on-demand, eliminating the need for costly infrastructure development.

Greater Scalability: On-premises IT infrastructure has a fixed capacity, requiring significant investments to accommodate changing demands. In contrast, cloud computing provides flexible scalability, enabling utilities to easily adjust resources and pay only for what they use. Especially with the ongoing energy crisis, companies need to be flexible and innovative to coop with the fluctuating energy prices and availability if they want to grow their businesses.

Lower Maintenance: While utilities often favour upfront capital investments over ongoing operating expenses, managing on-premises infrastructure incurs significant operational costs and necessitates skilled personnel. Cloud service providers take care of maintenance, upgrades, and management, reducing overall costs and easing the IT department's workload.

In addition to AI, cloud computing emerges as a viable solution to numerous challenges facing the data centre markets.

Why Partner with CMC?

Building a data centre can be challenging because of the talent shortage, high costs and knowledge gap. The scarce availability, redesign data centres and implementation new technologies leads to internal knowledge gaps, which is why your company may benefit from partnering with a specialised consultancy such as CMC.

Our advanced engineering experts deliver our flexible services to the mission-critical market. We partner with leaders in data centre construction and engineering projects, ensuring precision, security and compliance as required from start to finish. Our management solutions and expert consultants can lead at any stage, with a consistent, flexible service that can adapt to any changing project requirements. We don’t only provide consultants, but also transfer our knowledge to optimise your project. Above that, we have access to a global network of consultants with full background checks. What makes CMC different from other consultancies?

- Leading specialist professionals: Our qualified experts have experience across the product and software spectrum. If we don’t have the right person for your needs, we have the resources to find them and deploy them quickly.

- Global availability: With offices across Europe, USA and APAC and consultants based worldwide, we can provide expert solutions to any location,

at any time. - Tailor-made solutions: Our service is completely flexible, with bespoke solutions suited to you achieve your project goals and specialist support available quickly to overcome any challenges as soon as they arise.

- Transparent service: We provide you with extensive detail on our solutions. You can review consultant profiles before they begin working and receive regular reports throughout the delivery process.

- Consistency: We don’t swap out consultants or introduce new requirements mid-way through the process, we ensure each consultant is committed to providing the same level of service from inception to hand-over.

- Consultant care: Our contractor management service ensures all our consultants are informed, supported, and updated with feedback throughout a project, so they can continue delivering the best service.

- Solution focused approach: We work completely in line with your needs as a customer by providing a flexible offering which covers all engagement methods ranging from Statement of Work through to full turnkey solutions

About CMC

CMC is a specialised advanced engineering consultancy that delivers flexible services for mission-critical markets and projects. Are you looking for advanced engineering consultants for your next data centre project or do you need expertise advice? Contact us today to learn more about our services.